How to pay HDFC personal loan partial payment online? If you’ve ever found yourself asking this question, you’re not alone. With the advent of digital banking, managing loans online has become increasingly convenient, yet the process can sometimes be confusing. For HDFC Bank customers, paying a personal loan through partial payments can be a strategic way to manage finances, reduce interest, and shorten the loan tenure. This guide will walk you through the steps, provide expert advice, and offer insights into the benefits of making partial payments online.

HDFC Bank, one of India's leading banks, offers a range of personal loans tailored to meet various needs. Whether it’s a wedding, vacation, or emergency, personal loans can provide much-needed financial support. However, repayment can be a daunting task if not managed properly. By opting for partial prepayments, borrowers can ease their financial burden by lowering the principal amount, which in turn reduces the interest and the overall loan tenure. But how can one efficiently manage these payments online? This article delves into the intricacies of making partial payments online for HDFC personal loans.

In today’s fast-paced world, online banking provides the convenience and flexibility needed to manage personal finances effectively. As more people turn to digital solutions for financial management, understanding how to navigate these platforms becomes essential. This article aims to demystify the process of making partial payments on HDFC personal loans through online banking, providing you with step-by-step instructions, tips, and tricks to maximize your savings and manage your loan efficiently. So, let’s dive in and explore how to make partial payments on your HDFC personal loan online.

Table of Contents

- Understanding Personal Loans

- Benefits of Partial Payments

- Eligibility for Partial Payment

- Step-by-Step Guide to Making Partial Payments

- Using HDFC NetBanking

- Using HDFC Mobile Banking App

- Common Issues and Solutions

- Understanding Charges and Fees

- Impact on Credit Score

- Alternatives to Partial Payments

- Financial Planning Tips

- Frequently Asked Questions

- Conclusion

Understanding Personal Loans

Personal loans are unsecured loans provided by financial institutions to meet personal needs. Unlike home or auto loans, personal loans don't require collateral, making them accessible to a broader audience. They come with fixed interest rates, and the repayment tenure typically ranges from 1 to 5 years. HDFC Bank offers personal loans with competitive interest rates, quick processing, and minimal documentation.

One of the key features of personal loans is their flexibility. Borrowers can use the funds for various purposes without any restrictions. However, since these loans are unsecured, they often come with higher interest rates compared to secured loans. Therefore, managing personal loan repayments efficiently is crucial to avoid financial strain.

To apply for a personal loan with HDFC Bank, customers must meet certain eligibility criteria, including age, income, and credit score requirements. Once approved, the loan amount is credited to the borrower's account, and the repayment begins as per the agreed schedule. HDFC Bank provides the option to make partial payments on personal loans, offering borrowers a way to reduce their debt burden ahead of schedule.

Benefits of Partial Payments

Partial payments on personal loans can be a game-changer for borrowers looking to manage their debt more effectively. By making partial payments, borrowers can reduce the principal amount, leading to a decrease in the overall interest paid over the loan tenure. This not only saves money but also shortens the loan duration, allowing borrowers to become debt-free faster.

Moreover, making partial payments can improve a borrower's credit score. Consistently reducing the outstanding balance demonstrates financial responsibility and can positively impact creditworthiness. Additionally, partial payments provide flexibility in managing monthly finances, as borrowers can choose to make payments when they have surplus funds, without being tied to a fixed schedule.

For HDFC Bank customers, the option to make partial payments online adds an extra layer of convenience. With digital banking platforms, borrowers can easily manage their loan repayments from the comfort of their homes, without the need to visit a bank branch. This not only saves time but also ensures that payments are made promptly, reducing the risk of late fees or penalties.

Eligibility for Partial Payment

Before making a partial payment on your HDFC personal loan, it's essential to understand the eligibility criteria. Not all loans or borrowers may qualify for partial payments, and certain conditions must be met. Typically, borrowers must have a good repayment history with no defaults or missed payments to be eligible for partial payments.

Additionally, HDFC Bank may have specific terms regarding the minimum and maximum amount that can be paid as a partial payment. It's crucial to review the loan agreement or consult with a bank representative to understand these terms and ensure compliance. Borrowers should also be aware of any associated fees or charges that may apply to partial payments, as these can impact the overall cost savings.

For those eligible, making partial payments can be a strategic move in managing loan repayments effectively. It allows borrowers to pay down the principal faster, reducing the interest burden and paving the way to financial freedom. Understanding the eligibility criteria and associated terms is the first step in leveraging partial payments to your advantage.

Step-by-Step Guide to Making Partial Payments

Making partial payments on your HDFC personal loan is a straightforward process, provided you follow the correct steps. Here's a detailed guide to help you navigate the process efficiently:

- Review Loan Terms: Before making a partial payment, review your loan agreement to understand the terms and conditions. Check for any clauses related to partial payments, fees, or penalties.

- Calculate the Amount: Determine how much you can afford to pay as a partial payment. Consider your monthly budget and any upcoming financial commitments to ensure affordability.

- Access Online Banking: Log in to your HDFC NetBanking or Mobile Banking App using your credentials. Ensure you have a stable internet connection for a seamless transaction.

- Select Loan Account: Navigate to the 'Loans' section and select your personal loan account. This will display your outstanding balance and other loan details.

- Choose Partial Payment Option: Look for the option to make a partial payment. Enter the desired amount and confirm the transaction details before proceeding.

- Verify Transaction: After completing the payment, verify the transaction by checking your loan account statement. Ensure the partial payment has been credited correctly.

- Maintain Records: Keep a record of the transaction receipt for future reference. This can be useful in case of discrepancies or for tracking your loan repayment progress.

By following these steps, you can efficiently make partial payments on your HDFC personal loan, reducing your debt burden and paving the way to financial freedom.

Using HDFC NetBanking

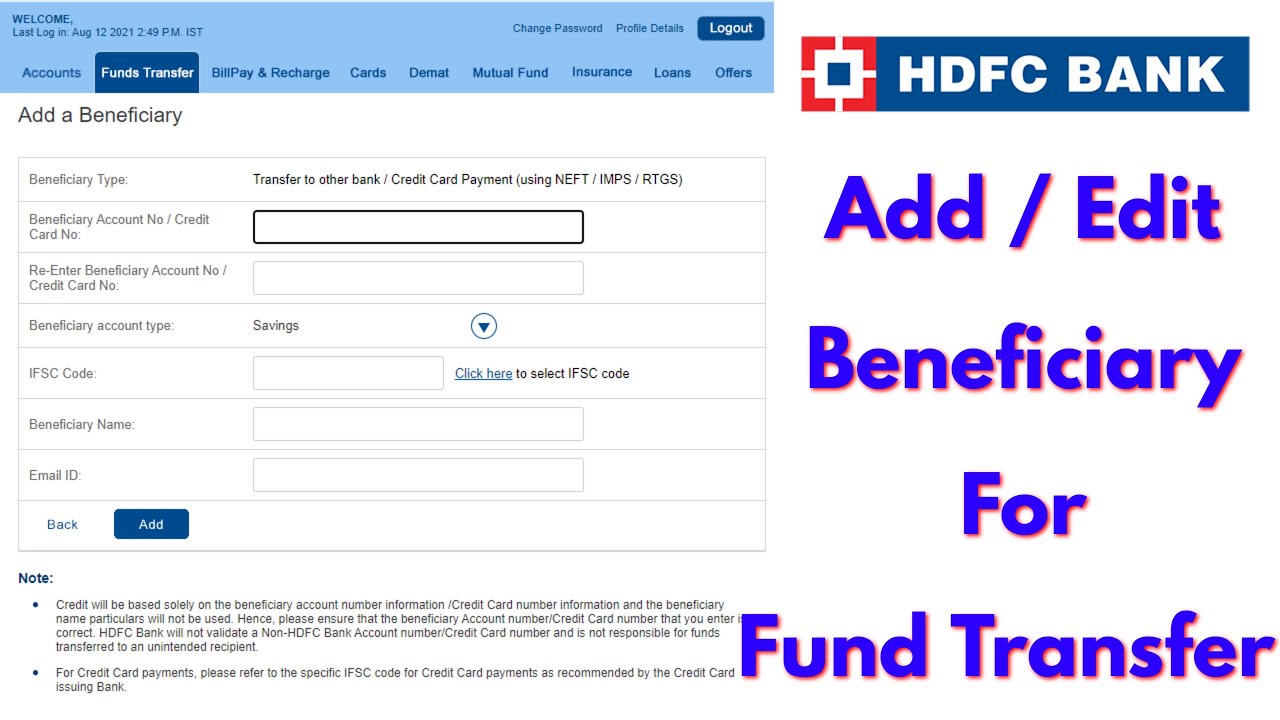

HDFC NetBanking is a robust platform that offers a range of financial services, including the ability to make partial payments on personal loans. Here's how you can leverage this platform to manage your loan efficiently:

Step 1: Log in to your HDFC NetBanking account using your customer ID and password. If you haven't registered for NetBanking, you can do so by visiting the HDFC Bank website and following the registration process.

Step 2: Once logged in, navigate to the 'Loans' section on the dashboard. Here, you'll find a list of your active loan accounts, including your personal loan.

Step 3: Select the personal loan account for which you wish to make a partial payment. This will display the current outstanding balance and loan details.

Step 4: Look for the option to make a 'Partial Prepayment.' Enter the amount you wish to pay and review the terms and conditions associated with the transaction.

Step 5: Confirm the transaction by entering the OTP (One-Time Password) sent to your registered mobile number. This ensures the security and authenticity of your transaction.

Step 6: After completing the payment, verify the transaction by checking your loan account statement. Ensure the partial payment has been credited correctly and the outstanding balance has been adjusted accordingly.

HDFC NetBanking offers a secure and convenient way to manage your personal loan repayments, allowing you to make partial payments with ease.

Using HDFC Mobile Banking App

The HDFC Mobile Banking App provides a user-friendly interface for managing your finances on the go. Making a partial payment on your personal loan through the app is a seamless process. Here's how to do it:

Step 1: Download and install the HDFC Mobile Banking App from the Google Play Store or Apple App Store. Log in using your customer ID and password.

Step 2: Once logged in, tap on the 'Loans' section to view your active loan accounts. Select the personal loan account for which you wish to make a partial payment.

Step 3: Tap on the 'Partial Payment' option and enter the amount you wish to pay. Review the transaction details and ensure there are no errors.

Step 4: Confirm the transaction by entering the OTP sent to your registered mobile number. This step ensures the security of your transaction.

Step 5: After completing the payment, check your loan account statement to verify the transaction. Ensure the partial payment has been credited correctly and the outstanding balance has been adjusted.

The HDFC Mobile Banking App provides a convenient way to manage your personal loan repayments from anywhere, at any time.

Common Issues and Solutions

While making partial payments online is generally a smooth process, borrowers may encounter some common issues. Here are a few problems you might face and their solutions:

- Transaction Failures: If your partial payment transaction fails, check your internet connection and ensure your bank account has sufficient funds. Retry the transaction or contact HDFC customer support for assistance.

- Incorrect Amount Deducted: Verify the transaction details before confirming the payment. If an incorrect amount is deducted, contact HDFC Bank immediately to rectify the issue.

- Payment Not Reflected: If your partial payment is not reflected in your loan account statement, allow some time for the transaction to process. If the issue persists, contact HDFC customer support.

- Technical Glitches: In case of app or website technical glitches, try accessing the platform from a different device or browser. If the issue continues, report it to HDFC Bank.

- OTP Not Received: Ensure your registered mobile number is active and has network coverage. Request a resend of the OTP or contact HDFC Bank for further assistance.

By being aware of these common issues and their solutions, you can effectively manage any challenges that arise during the partial payment process.

Understanding Charges and Fees

Before making a partial payment on your HDFC personal loan, it's essential to understand the associated charges and fees. While partial payments can lead to significant savings, being aware of any costs involved is crucial to make informed decisions.

Prepayment Charges: HDFC Bank may levy prepayment charges on partial payments. These charges are usually a percentage of the prepayment amount and are mentioned in the loan agreement. Review the terms to understand the applicable charges.

Processing Fees: Some banks charge a processing fee for handling partial payments. While this fee is generally nominal, it's essential to be aware of it to calculate the overall cost savings accurately.

GST: Goods and Services Tax (GST) may be applicable on prepayment charges and processing fees. Ensure you factor in these taxes when calculating the total cost of making a partial payment.

Understanding these charges and fees helps you make informed decisions and ensures that partial payments are truly beneficial in reducing your loan burden.

Impact on Credit Score

Making partial payments on your personal loan can positively impact your credit score. Here's how:

Reduced Outstanding Balance: Partial payments reduce the principal amount, leading to a lower outstanding balance. This demonstrates financial responsibility and improves your credit utilization ratio, positively impacting your credit score.

Timely Payments: Consistently making partial payments shows lenders that you are committed to repaying your debt. Timely payments contribute to a positive credit history, which is a significant factor in determining your credit score.

Lower Interest Burden: Reducing the principal amount through partial payments decreases the interest burden, allowing you to manage your finances better. This financial stability reflects positively on your creditworthiness.

By understanding the impact of partial payments on your credit score, you can leverage them to improve your financial standing and secure better loan terms in the future.

Alternatives to Partial Payments

While partial payments are an effective way to manage personal loan repayments, there are alternative strategies that borrowers can consider:

- Loan Restructuring: If you face financial difficulties, consider discussing loan restructuring options with HDFC Bank. This could involve extending the loan tenure or revising the repayment schedule to make it more manageable.

- Balance Transfer: Explore the possibility of transferring your outstanding loan balance to another lender offering lower interest rates. This can reduce the overall interest burden and make repayments more affordable.

- Debt Consolidation: If you have multiple loans, consider consolidating them into a single loan with a lower interest rate. This simplifies repayments and can lead to cost savings.

- Increasing EMI: If your financial situation allows, consider increasing your monthly EMI to pay off the loan faster. This reduces the principal amount more quickly and saves on interest.

By exploring these alternatives, borrowers can find the best strategy to manage their loan repayments effectively and achieve financial stability.

Financial Planning Tips

Effective financial planning is crucial for managing personal loans and achieving financial goals. Here are some tips to help you plan better:

- Budgeting: Create a monthly budget to track your income and expenses. Identify areas where you can cut costs to allocate more funds towards loan repayments.

- Emergency Fund: Build an emergency fund to cover unexpected expenses. This ensures you don't have to dip into your loan repayment funds during emergencies.

- Set Financial Goals: Establish short-term and long-term financial goals to stay motivated. Use these goals to guide your financial decisions and prioritize loan repayments.

- Monitor Credit Score: Regularly monitor your credit score to ensure it reflects your financial behavior accurately. Address any discrepancies promptly to maintain a healthy credit score.

By incorporating these financial planning tips into your routine, you can manage your personal loan repayments effectively and achieve financial freedom.

Frequently Asked Questions

Here are some common questions about making partial payments on HDFC personal loans:

- Can I make multiple partial payments on my HDFC personal loan?

- Is there a minimum amount required for a partial payment?

- Will making a partial payment affect my EMI?

- Are there any charges for making a partial payment?

- Can I make a partial payment through cash at an HDFC branch?

- How long does it take for a partial payment to reflect in my loan account?

Yes, you can make multiple partial payments on your HDFC personal loan, subject to the terms and conditions outlined in your loan agreement.

HDFC Bank may have a minimum amount requirement for partial payments. Check with the bank or review your loan agreement for specific details.

Making a partial payment reduces the principal amount, which can lead to a reduction in the EMI or the loan tenure, depending on the terms agreed upon with the bank.

HDFC Bank may levy prepayment charges on partial payments. Review your loan agreement to understand the applicable charges and fees.

Yes, partial payments can also be made in cash at an HDFC branch. However, making payments online offers convenience and saves time.

Partial payments made online usually reflect in your loan account within 1-2 business days. If there is a delay, contact HDFC customer support for assistance.

Conclusion

Managing personal loan repayments effectively is essential for maintaining financial stability and achieving long-term financial goals. By understanding the process of making partial payments online with HDFC Bank, borrowers can reduce their debt burden, save on interest, and improve their credit score. This comprehensive guide provides the necessary information and tips to navigate the partial payment process efficiently, empowering borrowers to take control of their financial future. Whether you choose to use HDFC NetBanking or the Mobile Banking App, the convenience and flexibility offered by online platforms make managing personal loans easier than ever. Remember to review the terms and conditions, understand the associated charges, and explore alternative strategies to find the best approach for your financial situation. With the right planning and execution, partial payments can be a powerful tool in your financial toolkit.